Central Texas Homeownership Guide: Real Conversations, Real Mortgage Solutions

07/29/2025

By: Josh Cizek

Why Homeownership Matters in Central Texas (and Beyond)

Homeownership means more than holding a deed—it’s about establishing roots, gaining financial stability, and investing in your future. At Keystone Bank, we see this every day in communities like Austin, Bee Cave, Dripping Springs, Bastrop, and Ballinger. In a region that continues to grow rapidly, buying a home is both a major milestone and a smart long-term move.

We’re a community bank that lives here too. While we’re proud to serve Central Texas with deep local expertise, our lending reach extends nationwide, so we can help you buy a home whether you're settling in Austin, relocating to Colorado, or planting roots in Florida. That means we offer lending solutions that work for our neighbors—and for future homeowners across the U.S.

Let’s Talk About Mortgages

At its core, a mortgage is a loan to help you buy a house. Behind that simple idea are layers of choices that can either help you thrive or leave you overwhelmed.

There’s a difference between hearing "You qualify" and "Let’s talk about what really works for your budget and future." We do the latter.

At Keystone Bank, we take the time to:

- Understand your lifestyle, income, and goals.

- Explain the difference between conventional, FHA, VA, and Portfolio loans in a way that is easy for anyone to understand.

- Guide you through pre-qualification so you can shop with confidence.

Local Knowledge. Local Decisions.

Big banks make decisions based on spreadsheets in distant boardrooms. We make ours locally. In Bee Cave. In Austin. In Ballinger. In Bastrop. In the neighborhoods we live in.

That means when you walk into our branch (or open our app), you’re not just a number, you’re a neighbor, and we’ll treat you like one.

Our mortgage team knows the ins and outs of buying in Travis, Williamson, Hays, Bastrop, Runnels, or any other county in Texas—and we bring that same level of care and clarity to clients purchasing across the country. We understand what local underwriters look for and advocate for you, as if it’s our own name on the application.

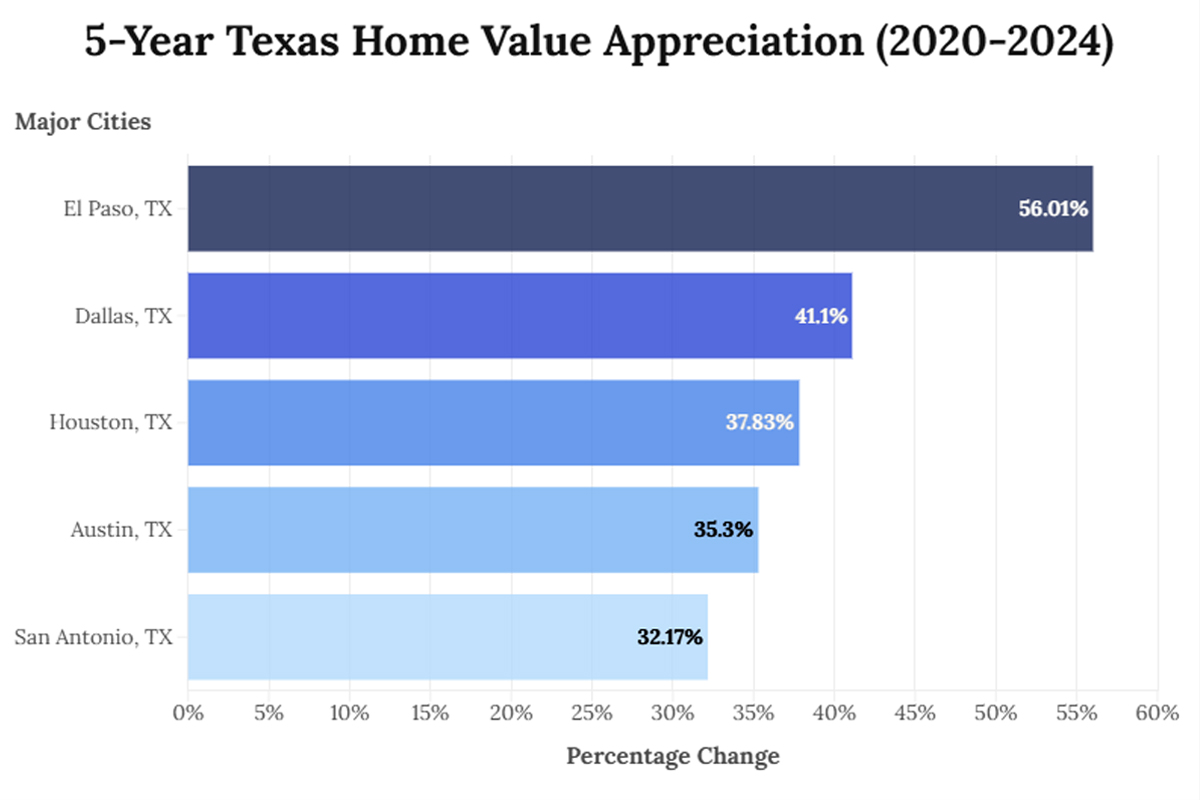

What’s Really Happening in the Central Texas Housing Market?

Let’s get real: the market isn’t what it was like two years ago, and that’s okay.

- Inventory is improving, giving buyers more options.

- Mortgage rates currently hover around 6.8% for a 30-year loan (Freddie Mac PMMS, June 2025), below the 50-year average of 7.7%.

- Home appreciation remains strong in key ZIP codes like 78704, 78613, and 78738.

In other words? It’s not about timing the market—it’s about finding the right fit and the right partner. We’re not here to push you into a home before you’re ready. We’re here to educate you. Empower you. And stand by you when the time is right.

Why This Matters

When the national market fluctuates, community banks like Keystone remain rooted in local insights, offering more flexible lending options and faster approvals than larger institutions.

Source: Zillow

Chart created by Josh Cizek, Keystone Bank

The Step-by-Step Mortgage Guide

Buying your first home can feel overwhelming, but it doesn’t have to be. Here’s how to get started:

1. Check Your Credit Score

Before anything else, it’s important to understand your credit health. Your credit score affects the interest rates you’ll qualify for, how much you can borrow, and even how quickly you’ll be approved.

You can check your credit report and score for free from these reputable sources:

- AnnualCreditReport.com: The only federally authorized source for a free weekly credit report from Equifax, Experian, and TransUnion.

- Credit Karma: Offers free TransUnion and Equifax scores along with credit monitoring tools.

- Credit Sesame: Provides access to your TransUnion score and personalized credit tips.

- Your Bank or Credit Card Provider: Many, including Keystone Bank, show your score in-app.

2. Determine What You Can Comfortably Afford

This step is just as important, and often more confusing for first-time buyers. Your income, debt, expenses, and down payment all play a role in determining how much house you can afford.

Here’s how to make it easier:

- Estimate Your Monthly Payment: Include more than just the mortgage. Add property taxes, homeowner’s insurance, PMI and HOA (if applicable), and maintenance costs to your payment plan.

- Use The 28/36 Rule: Aim to spend no more than 28% of your gross monthly income on housing costs and keep total debt payments (housing + other loans/credit cards) under 36% of your gross income.

- Use a Mortgage Calculator: Try the Mortgage Payment Calculator to model your monthly payments based on different loan types, terms, and rates.

- Plan for Upfront Costs: Budget 3-20% for a downpayment, 2–5% for closing costs, and a bit extra for miscellaneous costs, such as inspection and appraisal fees, moving expenses, and initial utility setup.

3. Get Pre-Qualified with Keystone Bank

We’re local. We make decisions fast. And our mortgage specialists talk to you like a human, not a credit report. Get Pre-Qualified Today

4. Find a Realtor Who Gets You

Partner with an agent who understands the local landscape and your goals. We’re happy to recommend trusted professionals.

5. Make an Offer and Let’s Close Together

We’ll walk you through the paperwork, timelines, and closing processes, no guesswork, no confusion.

Your Mortgage Options with Keystone Bank

We don’t believe in one-size-fits-all lending. Here’s a quick breakdown:

| Loan Type | Best For | Key Benefits |

| Conventional | Strong credit, 3% down, credit score as low as 620 | Custom terms, no PMI at 20% |

| FHA | First-time buyers, credit score as low as 580 | Low down payment, flexible credit |

| VA | Veterans & military families | No down, no PMI, low rates |

| Portfolio | Self-employed, unique income, 20% down | Locally approved, more flexibility |

Five Common First-Time Buyer Pitfalls (And How to Dodge Them)

1. Skipping Pre-Qualification

Walking into the homebuying process without a pre-qualification letter is like showing up to a job interview without a résumé. Sellers and agents won’t take your offer seriously, and you may fall in love with a home you can’t actually afford.

Pro Tip: Start with Keystone Bank — our local team makes this step fast, personal, and easy.

2. Ignoring Closing Costs

Many first-time buyers focus on the down payment but often overlook closing costs, which typically account for 2–5% of the home’s purchase price. That’s thousands of dollars if you’re not prepared.

Pro Tip: Talk with our mortgage specialists early — we’ll help you understand the complete financial picture.

3. Stretching Too Thin

Just because a lender approves you for a certain amount doesn’t mean you should max it out. Future you might want room for travel, savings, repairs, or kids.

Pro Tip: Choose a monthly payment that fits comfortably into your lifestyle, not one that makes you house-poor.

4. Skipping the Inspection

That fixer-upper might look like a dream… until the roof leaks or the foundation cracks. Skipping the inspection could cost you far more than the price of the report.

Pro Tip: Always get a qualified home inspection (even on new builds).

5. Not Asking Questions

Mortgages can feel overwhelming, but silence isn’t a sign of strength. Your lender is your partner.

Pro Tip: Ask away. At Keystone Bank, we welcome questions, and we answer them in plain English.

Why Choose Keystone Bank for Your Mortgage?

Local Expertise, Personal Support

Our mortgages are handled by real people right here in Texas who understand and care about the communities we support—whether they’re down the street or across the country. From New Braunfels to Nashville, Dallas to Detroit, we're here to support you every step of the way.

Flexibility That Works for You

National lenders might deny unique situations—we don’t. With portfolio lending and tailored advice, we’re equipped to help more buyers.

Ongoing Relationships

We’re not here for just a transaction. We’re your long-term partner in financial growth, from your first mortgage to your next big step.

"We're not here to close a loan. We're here to open doors."

Fast Facts: Texas Mortgage Questions, Answered

Q: What credit score do I need to qualify for a mortgage?

A: Most buyers qualify with scores of 620+, but better scores may unlock better rates. FHA and VA loans may approve lower scores.

Q: How much should I put down?

A: The average is 6–10%, but Keystone offers loans with as little as 3% down or even 0% for qualified borrowers.

Q: How long does closing take?

A: With pre-qualification, many Keystone Bank buyers close within 30 days.

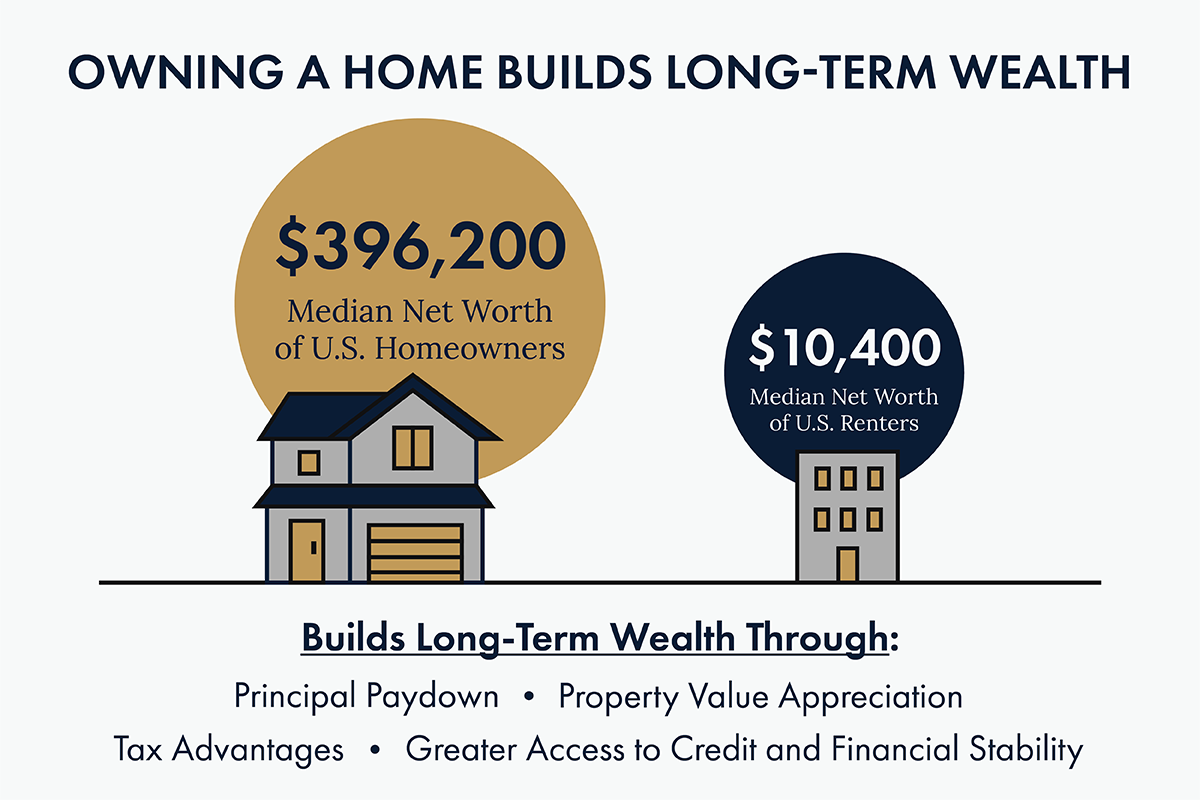

Why It All Matters: Building Wealth Over Time

According to the Federal Reserve’s 2022 Survey of Consumer Finances, the median net worth of U.S. homeowners is nearly 40x more than that of renters.

Homeownership builds equity. Equity builds wealth. And for many in Central Texas, that journey starts with one confident decision.

Source: Federal Reserve

Infographic created by Josh Cizek, Keystone Bank

Ready to Take the First Step? Let’s Make It Easy.

Whether you're ready to buy in Central Texas or anywhere else in the U.S., we’re here to walk the journey with you. Here's how you can get started:

- Schedule a no-pressure chat with our lending team.

- Learn more about our home loan options.

- Start your pre-qualification with just a few clicks.

Because at Keystone Bank, we’re not just funding mortgages, we’re building communities.

Keystone Bank NMLS 1816730.